Apple has launched its first savings account, allowing Apple Card owners to open a high-yield savings account through the company.

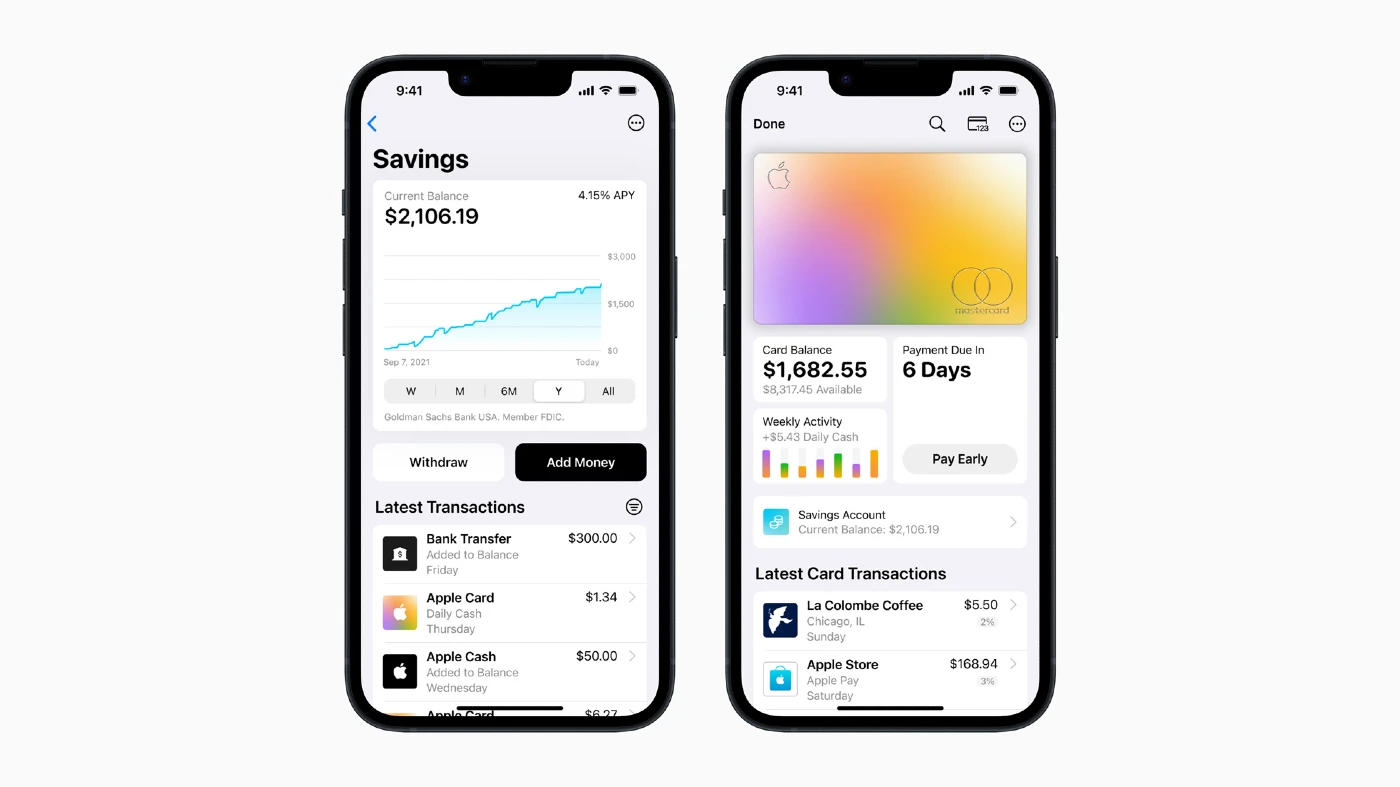

The service, available through partner Goldman Sachs, offers a 4.15 percent annual percentage yield (APY) and has no minimum balance or deposit requirements or fees.

Apple Card users who choose to open a savings account will see cash back earned from Apple Card purchases (up to 3 percent, depending on the merchant) automatically go into their savings account. If they don’t like this, they can change where the cash back goes through the Apple Wallet app.

Savings account holders can manage things via a Savings dashboard in the Wallet. The dashboard will let users link another (non-Apple) banking account for feeless transfers in both directions, as well as conduct transfers to and from an Apple Cash Card.

“Savings helps our users get even more value out of their favourite Apple Card benefit — Daily Cash — while providing them with an easy way to save money every day,” said Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet.

“Our goal is to build tools that help users lead healthier financial lives, and building Savings into Apple Card in Wallet enables them to spend, send, and save Daily Cash directly and seamlessly — all from one place.”

Everyone else is supposed to have access to the service “in the coming months,” Apple said in March.

Late last month, Apple launched Apple Pay Later, which essentially turned the company into a money-lender with the help of Goldman Sachs and MasterCard, to select customers.