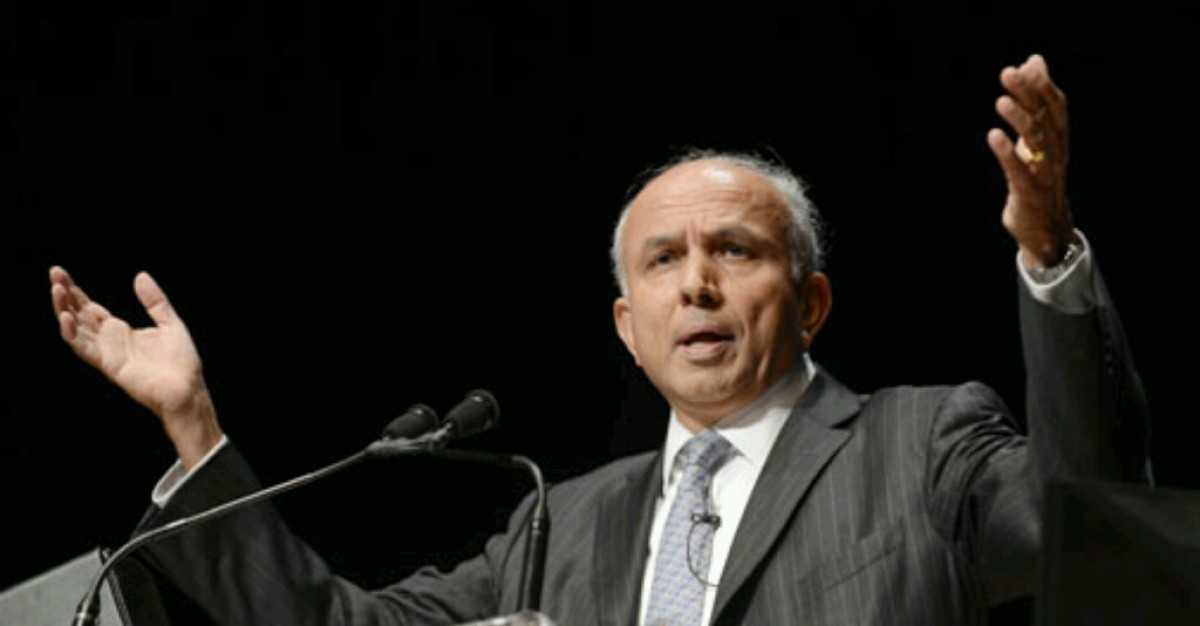

Dorsey Gardner, a veteran analyst and fund manager with about 5 million shares of BlackBerry, said investors should follow the advice of Glass Lewis & Co. and withhold their votes for Prem Watsa as lead director.

The proxy advisory firm says Watsa shouldn’t be re-elected to the role he’s held since 2013 because of executive pay that isn’t aligned with performance.

Watsa “is plainly unfit to serve as a director of the company, let alone its lead director and chair of the compensation, nomination and governance committee,” Gardner said in a written statement Monday.

Among Gardner’s complaints is the way Watsa’s investment and insurance company, Fairfax Financial Holdings Ltd., was allowed to buy up convertible debt from BlackBerry last year. The debt, which carries a conversion price of $6 a share, was a “sweetheart deal for Fairfax,” Gardner said.

Gardner fought the company over the financing last year. BlackBerry ultimately revised the terms, but the convertible deal allows Fairfax, which already owns about 8% of BlackBerry’s shares, to boost its ownership to more than 15%.

“Fairfax has significantly increased its stake, at a low price, paving the way for it to potentially make a lowball offer for BlackBerry’s remaining outstanding shares,” Gardner said in his statement.

The financing “was manifestly unfair to minority shareholders and the product of serious breaches of Watsa’s and all BlackBerry directors’ fiduciary duties of loyalty.”