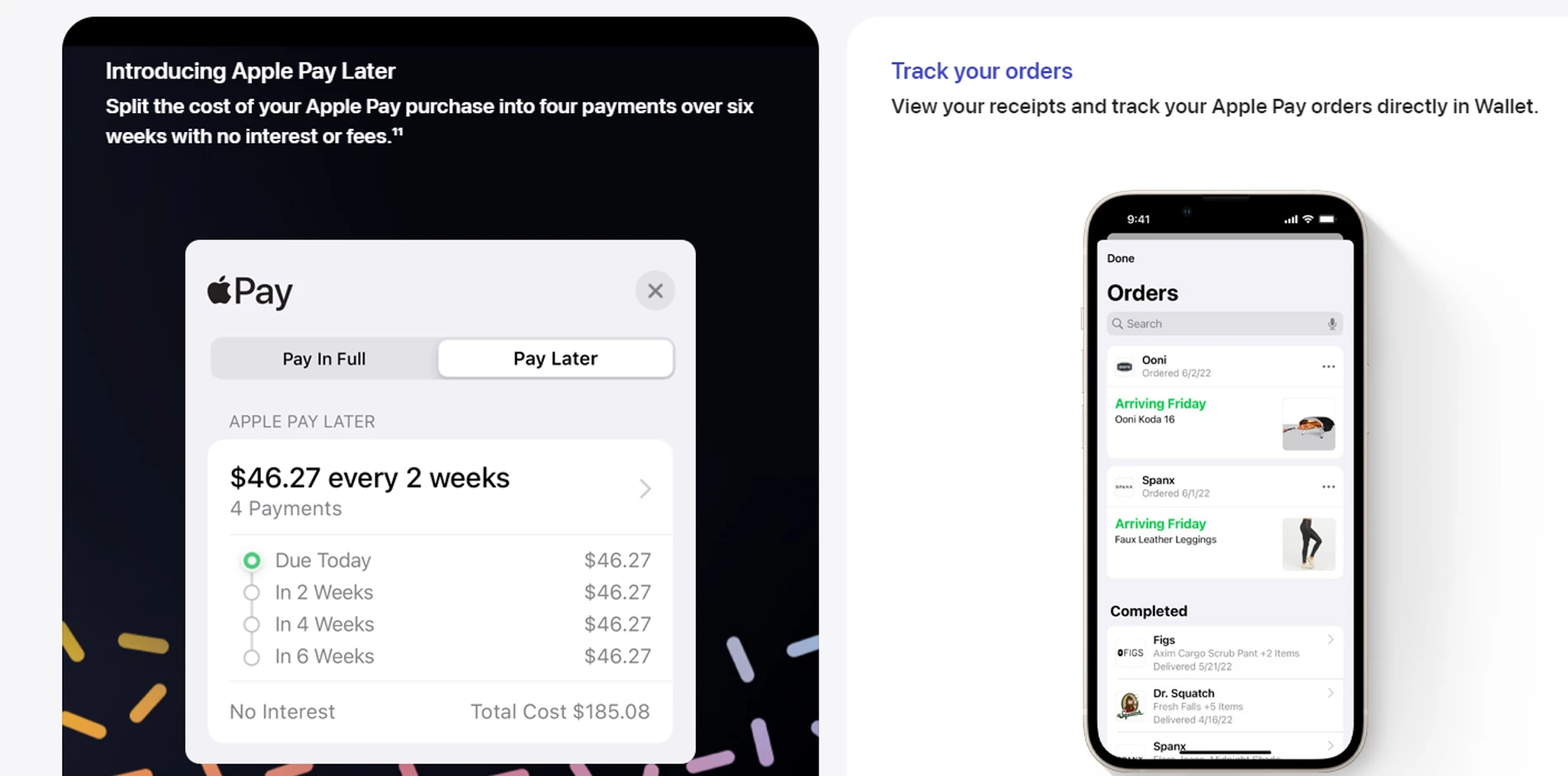

Apple has stepped into the buy now, pay later arena with Apple Pay Later, allowing users to split the cost of an Apple Pay purchase into four equal payments over six weeks without being charged interest or late fees.

Like existing BNPL options, Apple Pay Later will not charge interest on those purchases. However, unlike its major competitors, Apple said Apple Pay Later repayments will not attract late fees.

Built into Apple Wallet and designed with users’ financial health in mind, Apple Pay Later makes it easy to view, track, and repay Apple Pay Later payments within Wallet.

Users can apply for Apple Pay Later when they are checking out with Apple Pay, or in Wallet. Apple Pay Later is available everywhere Apple Pay is accepted online or in-app, using the Mastercard network.

Additionally, with Apple Pay Order Tracking, users can receive detailed receipts and order tracking information in Wallet for Apple Pay purchases with participating merchants.

Now Apple will compete with the likes of Klarna, Zilch and LayBuy in the buy now, pay later space, but Apple highlighted its plans to launch the service were more of an effort to help its iPhone users completely replace their physical wallet.

Apple Pay Later is coming as part of Apple’s iOS 16 software update which, if following Apple’s typical release cycle, will arrive mid-September.