Facebook has revealed its plans today for a new global digital currency, supported by more than two dozen companies ranging from Visa and Mastercard to Lyft and Spotify, bringing the heft of the world’s largest social network to efforts to transform financial services.

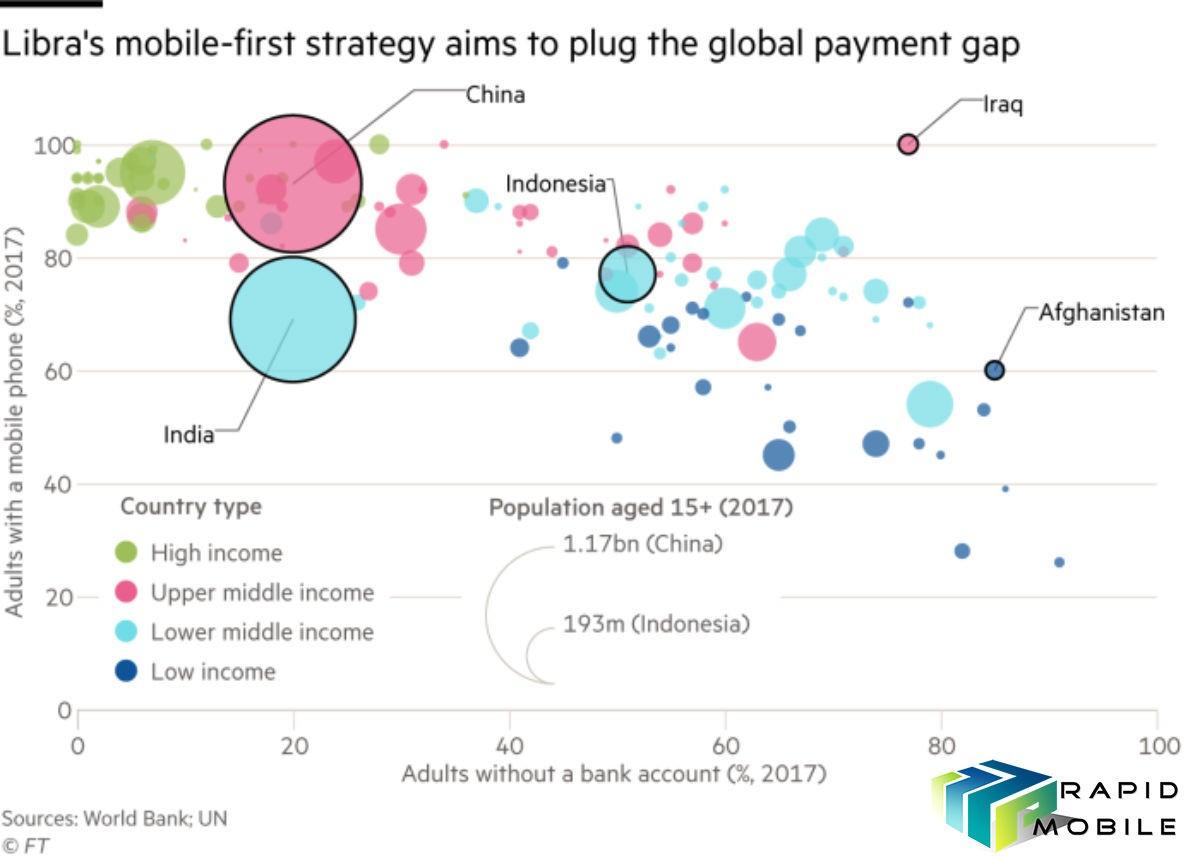

The scope of Facebook’s ambitions for the new currency, called Libra, was made clear as it claimed 1.7bn people around the world without a bank account would be able to use it to make instant and nearly free international money transfers from their mobile phones.

With traditional banks and the other large technology companies sitting on the sidelines for now, and with regulators taking a cautious approach to digital currencies, Facebook on Tuesday began the task of persuading merchants to use Libra as a means of payment and consumers to see it as a safe store of value.

“The internet . . . has given everyone access to the world’s information, and democratised access to free communications, but money has stayed the same,” said David Marcus, the former president of PayPal who joined Facebook in 2014 and has steered the Libra project.

So far 28 groups including payments companies, ecommerce groups and venture capital companies have said they will become backers and integrate the technology into their services. Some have signed up recently — PayPal said it had only been in talks with Facebook for a “few weeks” — but Facebook hopes that 100 groups will have joined before the currency launches next year. Each founding partner in the Libra Association is expected to contribute a minimum of $10m to help kick-start the project.

Libra will be backed by a pool of currencies and assets stored around the world. It will not have a fixed exchange rate against any one traditional currency, such as dollars and euros, though it will not swing as wildly as cryptocurrencies such as bitcoin.

Banks decided not to join the starting roster because of uncertainties about regulation and concerns over logistical issues that could hamper take-up, several industry executives said. Facebook’s move is the most significant effort yet to bring blockchain technology, which does not rely on a central authority to issue money, into the mainstream and comes after the launch of hundreds of digital currencies, not least the 10-year-old bitcoin.

“We believe that people will increasingly trust decentralised forms of governance,” said Facebook and its partners in a statement announcing their proposal.

If successful, the project could dramatically reshape some corners of the finance industry, disintermediating payments platforms and stealing business from retail banks and fintech groups, particularly those that specialise in sending payments across borders.

Jorn Lambert, executive vice-president for digital solutions at Mastercard, said he was not worried that fee-free transactions would threaten the payment card business.

“It’s an addition to what we do, not instead of what we do. It is not a zero-sum game. Today, 85 per cent of transactions are made in cash.”

It is unclear whether Libra will clear the steep hurdles needed to get off the ground, win over regulators such as the US Securities and Exchange Commission, and be embraced, or strongly resisted, by the financial services industry. Central banks have already questioned the impact of company-created cryptocurrencies on financial stability.

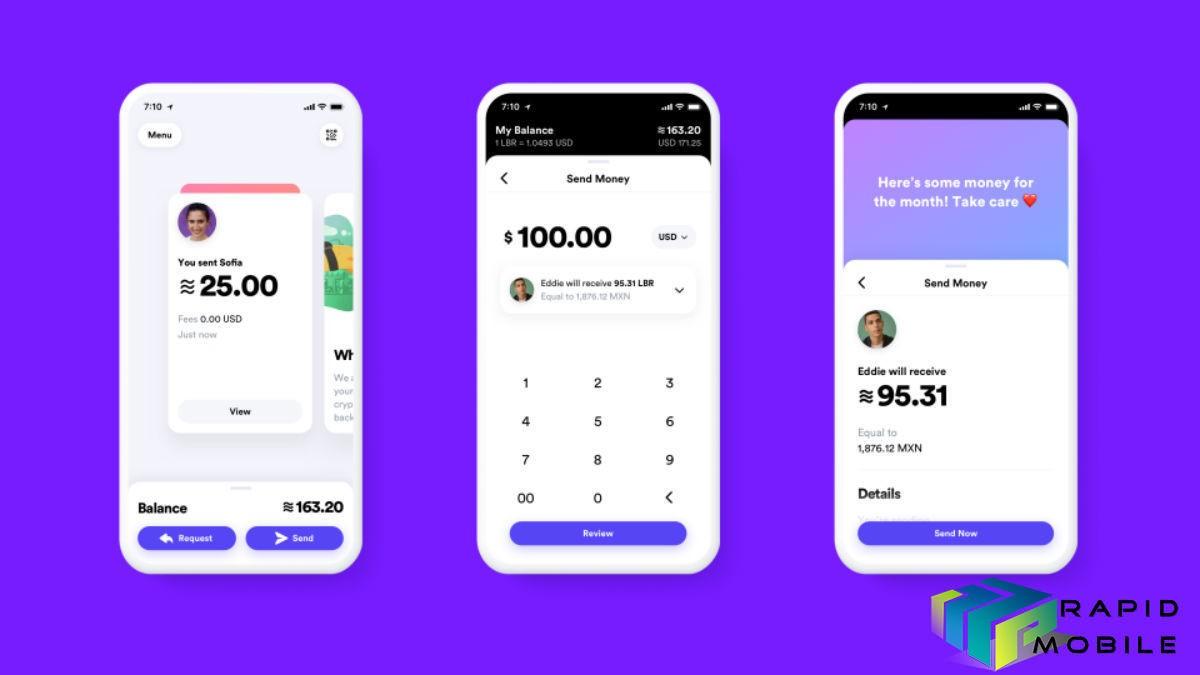

Facebook will spin off a unit, called Calibra, to manage its own digital wallet service, which will be integrated into its family of apps. Facebook said financial data gathered by Calibra would not be used to target advertising, and not be shared with Facebook or third parties “without customer consent”.

Facebook said know-your-customer information would be collected and government-issued ID would be required for accounts. It added that it would use computer programs to detect suspicious transactions.

Libra Current Backers

Payments: Mastercard, PayPal, PayU, Stripe, Visa

Tech and consumer: Booking Holdings, eBay, Facebook, Farfetch, Lyft, Mercado Pago, Spotify, Uber

Telecoms : Iliad, Vodafone

Blockchain : Anchorage, Bison Trails, Coinbase, Xapo Holdings

Venture Capital : Andreessen Horowitz, Breakthrough Initiatives, Ribbit Capital, Thrive Capital, Union Square Ventures

NGOs : Creative Destruction Lab, Kiva, Mercy Corps, Women’s World Banking