London-based fintech sync. is aiming to become the first digital smart open banking app offering an easy-to-use financial service across Europe, promising to manage every aspect of a user’s financial life in one place.

sync. says it was created out of frustration with traditional banks and the niche offering of new challenger banks that are not responding to all the needs of the end customer.

sync. was initially due to launch in March this year, but was delayed by the coronavirus pandemic, but the fintech made use of the lost time and has been testing out its app on existing users ever since.

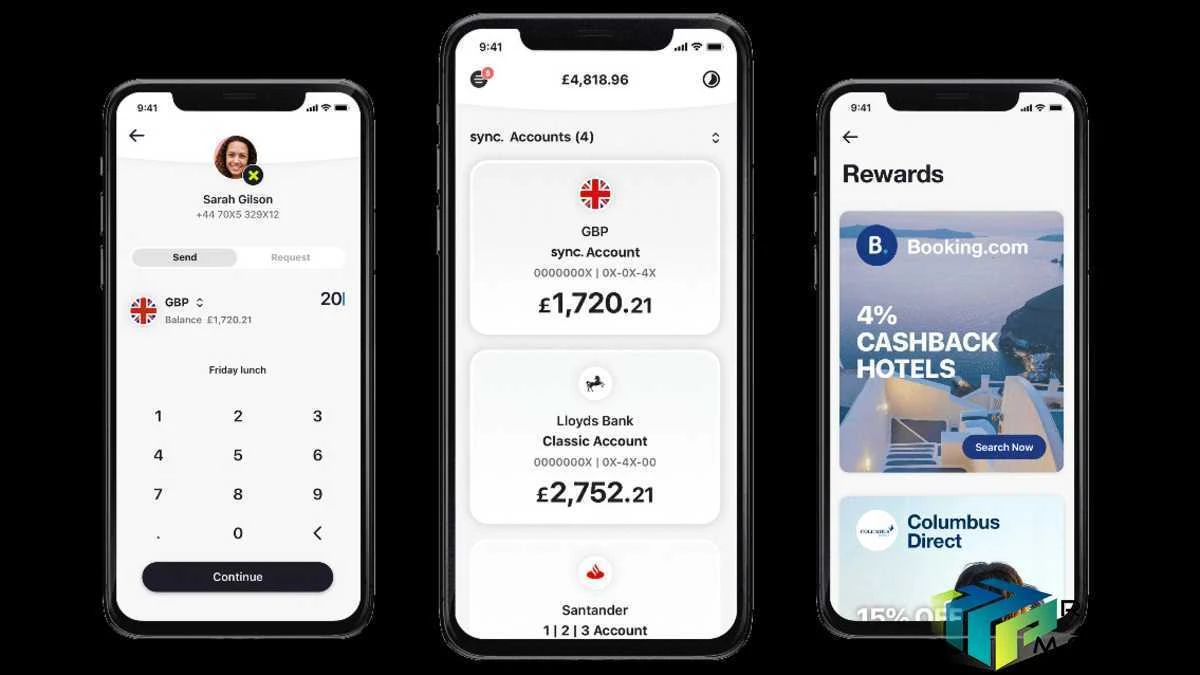

The app aims to differ from major challenger banks by not specialising in one area, like money management, travel/currency exchange or payments. Instead, it’s an all-in-one service that supports users with all their financial needs.

Their ultimate goal is to help customers budget, manage and track their money, in one place, offering a unique user experience as a money management platform with tailored insights.

While they encourage users to keep their existing accounts with traditional banks, the sync. app will be a way to manage their entire financial life in one app.

It does this by leveraging Open Banking, allowing users to connect all their debit and credit accounts, loans and mortgages, alongside their own sync. X card, powered by Mastercard.

The app’s features will include creating and holding money in a GBP and/or EUR current account, opening 30+ currency accounts with immediate currency exchange, money transfers, debit card payments, and worldwide instant digital payments (Peer-to-Peer & QR code).

Global Processing Services (GPS) has has partnered with sync., to power the payments processing function of sync.’s debit cards. GPS will work with sync. as its payments processor by providing connectivity to the payments ecosystem, including the Scheme and the card bureau, and allowing users to spend money at home and abroad. The partnership will allow sync. to successfully launch and scale in the UK and Europe.

Security is a big focus for the start-up. They offer disposable online cards alongside the physical sync. X card. The security code (CVC number) is not printed on the physical card and can be changed an infinite number of times through the app, giving users an extra layer of protection if their details are stolen.

Ricky Lee, CEO and Founder of sync., said:

“We are excited to open our app for users across Europe to test. We have been developing sync. for 18 months, and we are now ready to scale up and compete with the major challenger banks.”

sync. also recently announced it had closed a £5.5m seed and pre-seed round. The round, which was actually completed earlier on in 2020, will be used to grow the fintech’s employee numbers as well as bolster its beta launch across the European Economic Area.

sync. Is currently based out of London with an additional office in Malaga, Spain but has plans to open more offices across Europe as it grows, setting its sights on Lithuania.