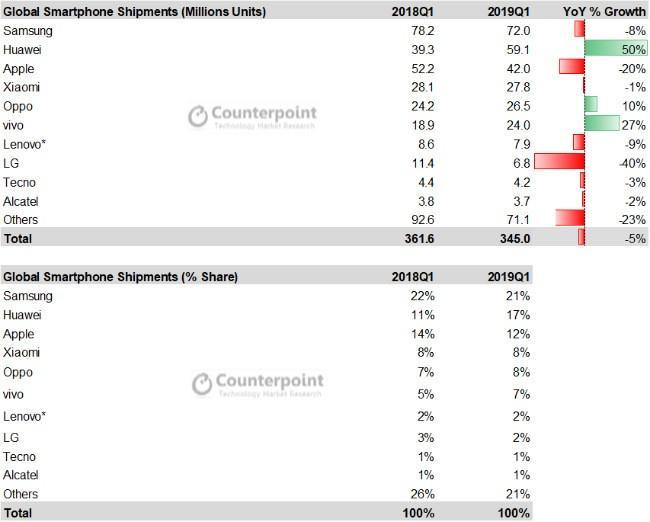

Huawei’s share in the global smartphone market reached its highest ever level of 17 percent during Q1 2019, according to two popular market research firms, Counterpoint Research and International Data Corporation (IDC).

Huawei has registered an increase in the global market share as well as smartphone shipments in the first quarter of 2019, while Samsung’s and Apple’s have dropped.

This comes at a time when Q1 2019 smartphone shipments are falling (of 5% as per Counterpoint, and 6.6% according to IDC) year-over-year (YoY) – making it the sixth consecutive quarter that has seen a decline in smartphone shipments.

According to Counterpoint Research, Huawei’s share in the global smartphone market reached its highest ever level of 17 percent during Q1 2019. Huawei overtook Apple as the second largest selling smartphone brand in the quarter as its volumes increased by nearly 50 percent YoY. Although, Samsung’s share decreased, it grabbed a market share of 21 percent maintaining the top spot. Apple was able to capture 12 percent of share globally.

Meanwhile, IDC says that Samsung took 23.1 percent, Huawei captured 19 percent and Apple got 11.7 percent share.

Recently, Huawei announced its business results for the first quarter of 2019 and said that the company generated CNY 179.7 billion in revenue – an increase of 39 percent (YoY). The company’s net profit margin in the quarter was about 8 percent, and it shipped 59 million smartphones.

Huawei became the second largest smartphone brand by shipments without a significant presence in an important market like the US. It was also the fastest growing brand among the top 10. Moreover, only Chinese brands Huawei, Oppo and Vivo were able to register a growth in the first quarter of 2019.

Shobhit Srivastava, Research Analyst at Counterpoint Research, said in a statement.

Shobhit Srivastava, Research Analyst at Counterpoint Research, said in a statement.

“At this pace, we expect Huawei to remain ahead of Apple at the end of 2019. What has helped Huawei is the pace of its innovations. It was the first to introduce features like reverse wireless charging, on-board AI, advanced camera, and more. A dual-brand (HONOR) strategy has helped Huawei build a youth connect and gain market share in a sluggish Chinese market.

Huawei is now a match for Samsung in smartphone hardware. Like Samsung and Apple, Huawei also is becoming increasingly vertically integrated. We believe it is Huawei that Samsung should be worrying about rather than Apple,”

Ryan Reith, Program Vice President with IDC’s Worldwide Mobile Device Trackers, added,

“It is becoming increasingly clear that Huawei is laser focused on growing its stature in the world of mobile devices, with smartphones being its lead horse. The overall smartphone market continues to be challenged in almost all areas, yet Huawei was able to grow shipments by 50 percent, not only signifying a clear number two in terms of market share but also closing the gap on the market leader Samsung. This new ranking of Samsung, Huawei, and Apple is very likely what we’ll see when 2019 is all said and done,”

While, Counterpoint Research says that the overall smartphone shipments fell to 345 million units from 361.6 million units registering a 5 percent decline, IDC found that smartphone vendors shipped a total of 310.8 million units from 332.7 million units in 1Q19.

Tarun Pathak, Associate Director at Counterpoint Research, said about the smartphone shipment decline,

“The global smartphone market showed no sign of recovery in Q1 2019. The rate of decline came down, particularly in February, due to inventory correction by some brands and the production halt during Chinese New Year. Another reason for the decline is lengthening replacement cycles, especially in the premium segment.

The replacement rate for iPhones is reaching close to 36 months, while the replacement rate for premium Android devices is closing in at 30 months. This can be attributed to the higher quality of devices, increasing average selling price (ASP), and the lack of innovative technology,”

Anthony Scarsella, Research Manager with IDC’s Worldwide Quarterly Mobile Phone Tracker, echoed Pathak’s comments saying,

“Consumers continue to hold on to their phones longer than before as newer higher priced models offer little incentive to shell out top dollar to upgrade. Moreover, the pending arrival of 5G handsets could have consumers waiting until both the networks and devices are ready for prime time in 2020.”