Short-term loans made through Apple’s new Apple Pay Later service will be made through a wholly owned subsidiary, Apple Financing LLC.

Apple Pay Later will be accepted by millions of US retailers that already take the iPhone’s mobile and online payments service, giving it a broad reach and an enviable customer base who can already afford to splash out on the company’s latest devices.

In the past, Apple has worked with Goldman Sachs to issue a credit card in the US, as well as with banks such as Barclays in the UK to offer financing for purchases of its own devices. However, those banks’ roles are diminished in its latest financial product.

Goldman Sachs is facilitating Apple Pay Later by allowing Apple to access Mastercard’s network, since Apple lacks a licence to issue payment credentials directly. But Apple is handling the underwriting and lending using its new subsidiary.

In a statement, Goldman said it was “excited about our partnership with Apple, which will only continue to grow”.

The set-up will allow Apple to earn interchange fees from each transaction as well as give the company more control over data and help accelerate international expansion of its financial products.

However, if a customer fails to pay back the loan, Apple must swallow the loss.

Though the company declined to disclose its specific financing mechanism, Apple can easily afford to lend off its own balance sheet, especially for short-term loans. It had net cash of $73bn at the end of March, according to its most recent quarterly results.

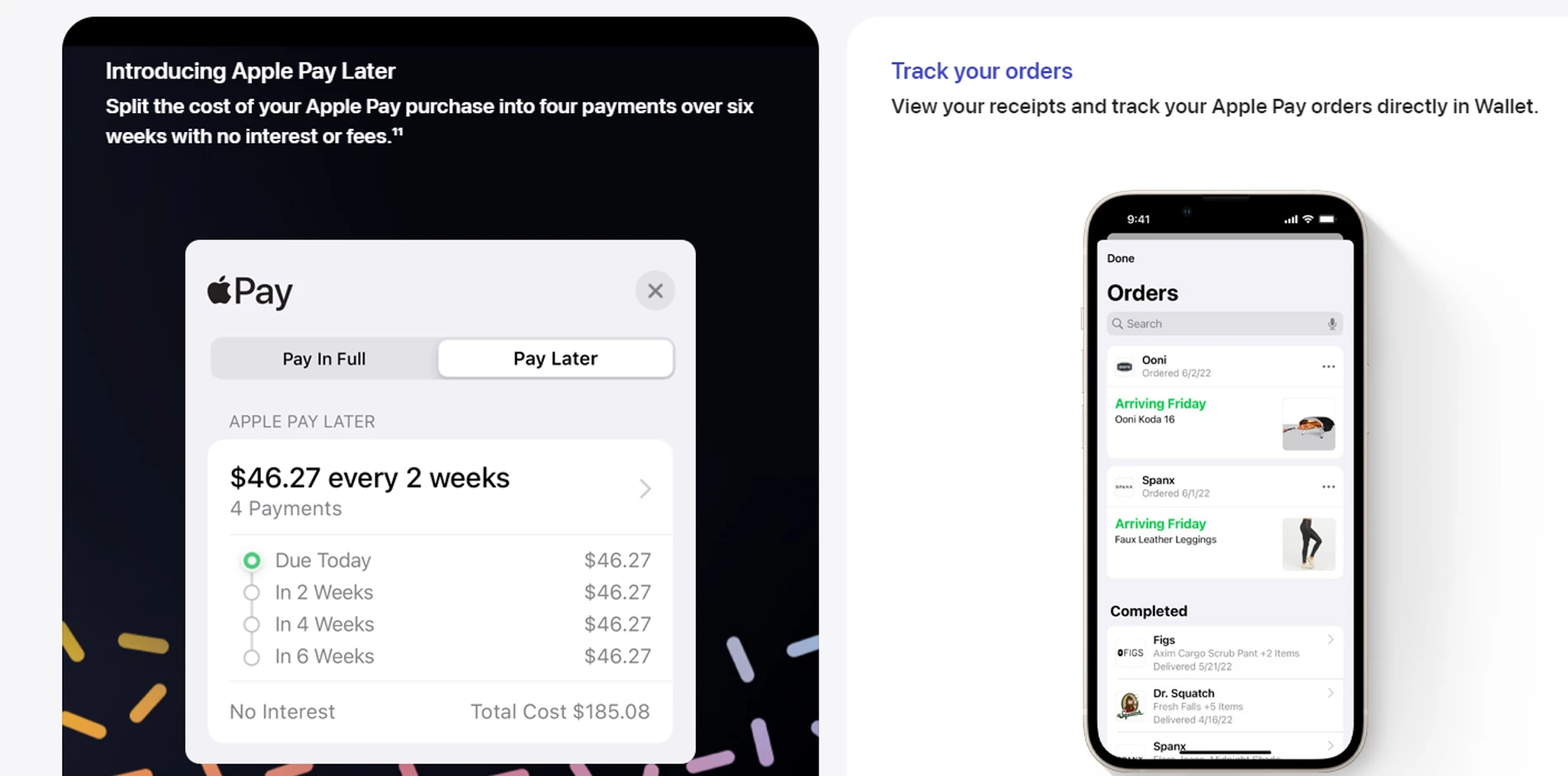

The “buy now, pay later” service is the latest addition to a growing suite of Apple financial services, all managed through the Wallet app that comes pre-installed on every iPhone.

Apple’s financial services, while growing, are still to be offered outside the U.S.

Apple Pay, which debuted in 2014, allows iPhone and Apple Watch owners to use credit and debit cards by tapping their devices to wireless readers in stores.

In 2017, Apple added the ability for users to make peer-to-peer payments through a service now called Apple Cash. Apple said it did not see a need to apply for a banking licence at this time.

Buyers of Apple’s premium-priced gadgets tend to have higher incomes than other tech customers, making them less of a lending risk.

Apple can also use customer data, such as how long users have owned an iPhone or how often they buy apps from the App Store, to help determine whether a customer is in good standing.

Apple said its decision to go it alone was in part taken to avoid sharing personal data with third parties.

The company will not charge fees for late payments, in line with Klarna and others, but will restrict access to further short-term credit.

In March, Apple bought UK-based fintech Credit Kudos. The start-up uses machine learning to create an alternative to traditional credit scores, which have been criticised as a way to accurately assess a consumer’s finances.