Apple has acquired Credit Kudos, a UK open banking start-up in a deal reportedly worth $150 million.

Credit Kudos provides information to lenders from the UK’s open banking framework to offer faster, automated decision-making about loans, fuelling rumours that Apple may be preparing to launch its Apple Card credit card here in the UK.

Back in 2019, Apple Card launched in the United States, created in partnership with investment banking company Goldman Sachs, allows users to track spending and help manage bills within the Wallet app on iOS – completely free, and with lower interest rates compared to traditional banks.

Users can make purchases using their Apple Card with Apple Pay on their iPhone, iPad, Apple Watch, and Mac, or with the optional titanium Apple Card banking card, which features no printed card number or security code, making it the world’s most secure credit card.

While it isn’t clear what Apple intends to do with Credit Kudos following the acquisition, it is more than likely the company’s technology could be used to launch Apple Card to customers in the UK, marking what would be the first international expansion of the service.

However, it could also be that the acquisition is to aid Apple’s operations in the US, making it easier to make more automated decisions about loans and Apple Card acceptance. With a bit of luck it will be both!

Open Banking

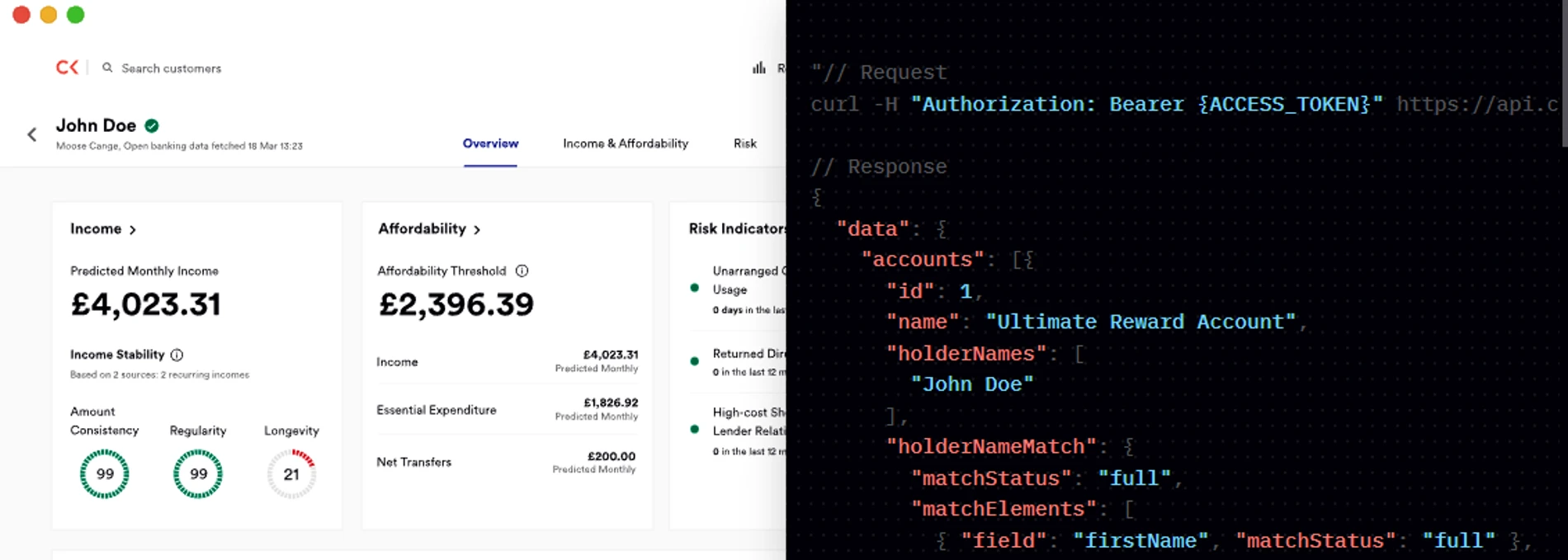

Open Banking technology allows you to share your financial information with your chosen provider, through a specially regulated company, like Credit Kudos. These specially regulated providers are called Account Information Service Providers (AISPs), and are authorised by the Financial Conduct Authority (FCA).

Credit Kudos, as a regulated AISP, provides an online process in which you can consent to share specific financial information from your bank and credit card providers with your chosen financial services company (this could be your lender, mortgage provider, estate agent, or broker, for example).

During the process, your bank will ask you to login to your online banking account to verify your identity, then ask you to confirm that you’d like them to share information with Credit Kudos. Your bank only shares the specific financial information you request with Credit Kudos, and never your login details.

You can connect multiple financial institutions at a time, enabling you to quickly and easily share your financial information – just as you would upload bank statements. Once you have connected your accounts, Credit Kudos consolidates all the information retrieved through Open Banking technology into a usable format for lenders, brokers, and banks. Only specially regulated companies, like Credit Kudos, can access Open Banking services.