The NatWest banking app is now available on Apple's Vision Pro, making the bank among the first global banks to feature its app on VisionOS.

The UK Infrastructure Bank (UKIB) has announced a £200m loan to support the development of AESC’s gigafactory in the North East of England.

Apple added a new feature for UK Apple Wallet users last month, allowing them to view their current bank account balance and transaction history directly within the app.

Apple is testing out a new feature for UK Apple Wallet users, allowing them to view their current bank account balance and transaction history directly within the app.

Swiss Bank Sygnum is launching a metaverse hub in the virtual equivalent of New York’s Times Square on September 27, 2022.

Swiss crypto bank Sygnum will open a metaverse hub on Decentraland, on 27 September 2022 at 11:00am CET.

Hoping Club has developed a decentralized trading platform and launched a developer program, where developers can focus on liquidity to build applications on the platform.

UK investment bank Standard Chartered has acquired a plot of virtual land at The Sandbox metaverse’s Mega City district.

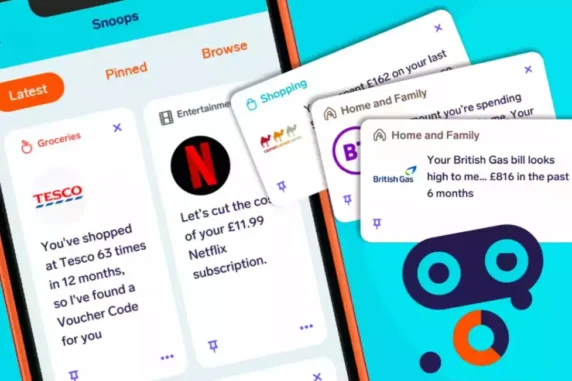

Huawei AppGallery has launched Snoop in the UK, providing users with access to money management tools across different banks.

The contactless card payment limit has been raised for the fifth time today (15 October). Initially set at £10 in 2007, it has now been raised to £100.

HSBC UK has launched a new voice-driven menu to assist its telephone banking customers, enabling callers to state their intent verbally and be directed to the correct team automatically

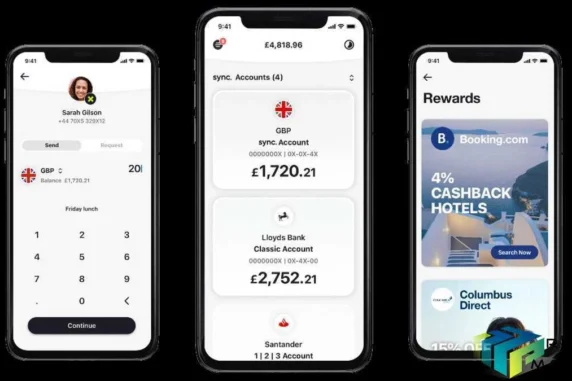

sync. is aiming to become the first digital smart open banking app offering an easy-to-use financial service across Europe, promising to manage every aspect of a user's financial life in one place. sync. says it was created out of frustration with traditional banks and the niche offering of new challenger banks that are not responding to all the needs of the end customer.