Square has launched its latest hardware offering, Square Register, a fully integrated countertop point-of-sale (POS) solution, designed to give UK businesses with complex needs the versatility they need to manage sophisticated operations.

Apple today announced financial results for its fiscal 2021 first quarter ended December 26, 2020, posting an all-time record revenue of $111.4 billion.

BlackBerry's U.S.-listed stock, which is on track for the highest close since December 2011, blasted 42.7% higher last week, the biggest weekly gain since the week ended Dec. 26, 2003. The stock jumped 43.5%, to $20.15 on Monday, reaching the highest price in 10 years.

BlackBerry has announced that it is scheduled to present at the following virtual investor conferences in January 2021

BlackBerry reported its Third Quarter Fiscal Year 2021 Results today, with revenue falling 18% to $218 million, compared with analysts' estimate of $219.7 million.

Nokia will hold an investor call on December 16, 2020 at 3 p.m. Finnish time (EET) to share the second phase of its refreshed strategy.

BlackBerry will report results for the third quarter of fiscal year 2021 at 5:30 p.m. ET on Thursday, December 17, 2020. The conference call can be accessed by dialling +1 (877) 682-6267 or live-streamed on the Company's website.

Salesforce is to spend $27.7 billion to acquire Slack in a cash-and-stock deal that will see Salesforce incorporate the company’s technology in a range of Salesforce cloud-based services.

Shares in BlackBerry gained as much as 63.9 per cent in intraday trading on Tuesday following news of a deal with Amazon Web Services to develop and market BlackBerry's intelligent vehicle data platform, called IVY.

BT has concluded the sale of its domestic operations in France to Computacenter. The transaction is part of BT’s ongoing transformation of its Global unit.

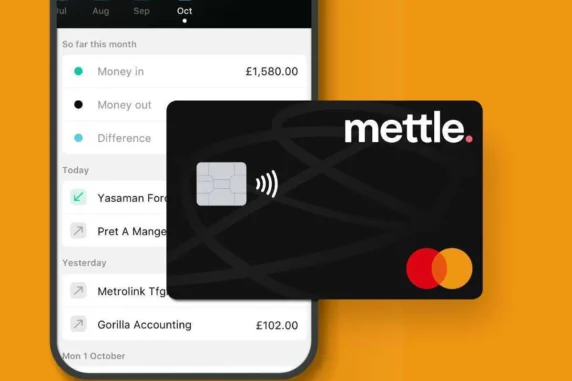

Users of NatWest's Mettle Business Account can now use their cards with Apple Pay, giving users the ability to make secure purchases online, in-app and in-store using Apple devices.

Ericsson has completed its acquisition of Cradlepoint. The investment is key to Ericsson’s ongoing strategy of capturing market share in the rapidly expanding 5G enterprise space.