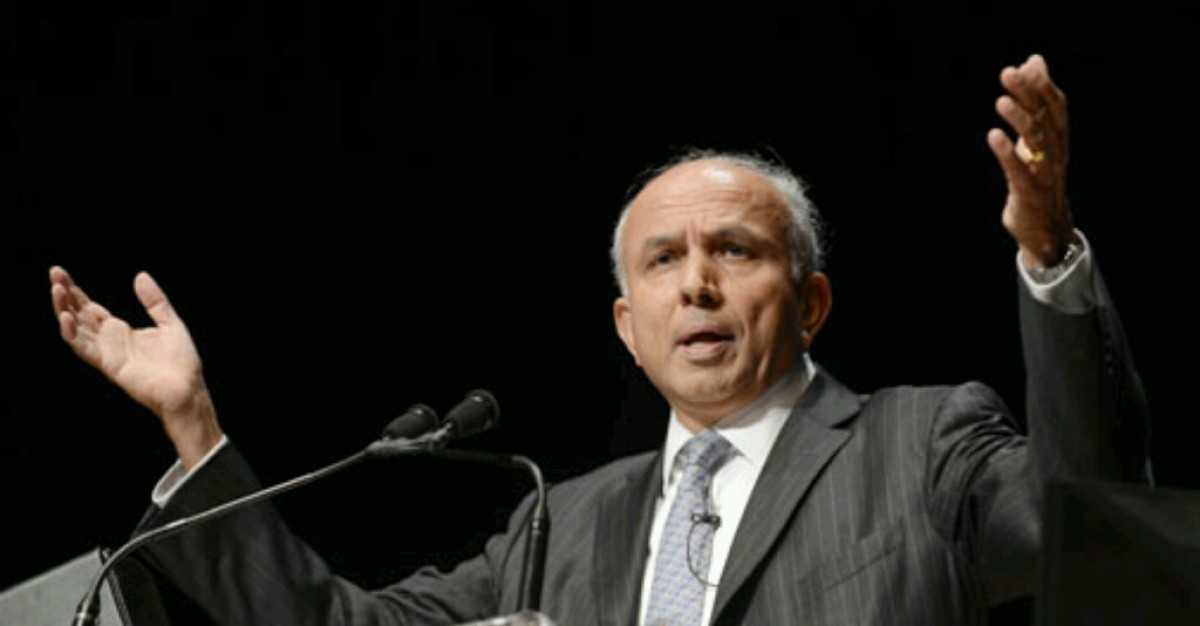

BlackBerry completed its debt refinancing Tuesday, which left Fairfax Financial holding 90% of new 1.75% BlackBerry convertible debt. On the same day, Billionaire investor Prem Watsa, leader of Fairfax Financial Holdings, upped his stake in BlackBerry by 117.99%.

According to GuruFocus Real-Time Picks, Watsa invested in 55.13 million shares of BlackBerry on Sept. 1, impacting the equity portfolio by 16.19%. The stock traded for an average price of $5.58 per share on the day of the transaction. Watsa now holds 101.8 million shares total, which represent 29.9% of the equity portfolio. GuruFocus estimates he has lost 27.11% on the investment so far.

BlackBerry currently sports a $3.01 billion market cap, shares were trading around $5.32 on Thursday with a price-book ratio of 89.91 and a price-sales ratio of 3.18. The median price-sales chart shows the stock is trading above its historical average, suggesting it is overvalued.

In June, the company reported its financials for the first fiscal quarter of fiscal 2021, reporting a $636 million loss.

GuruFocus rated BlackBerry’s financial strength 5 out of 10. In addition to its debt ratios underperforming verses competitors as well as company history, the Altman Z-Score of 0.51 warns it could be in danger of going bankrupt.

The return on invested capital is also surpassed by the weighted average cost of capital, indicating that the company has not profitably employed the capital it has received from investors and lenders.

The company’s profitability fared worse, scoring a 2 out of 10 rating on the back of a declining operating margin and negative returns that under-perform a majority of industry peers. BlackBerry also has a moderate Piotroski F-Score of 4, which indicates business conditions are stable. The predictability rank of one out of five stars, however, is on watch as a result of declining revenue per share over the past five years.