Earlier last week it was reported that Billionaire John Malone’s Liberty Global, which owns Virgin Media and a 10% stake in ITV, was in talks with Spanish telecoms giant Telefonica to combine their UK assets in a joint venture.

Both companies have now officially confirmed an agreement to merge their operating businesses in the U.K. to form a 50:50 joint venture.

The joint venture between Virgin Media and O2 brings together the mobile operator’s 34m customers, the largest network in the UK, with the cable operator’s 5.3m broadband, pay-TV and mobile users.

In addition, the joint venture will become a leading challenger in the B2B space as the combination will accelerate the adoption of converged fixed-mobile services to Virgin Media’s and O2’s existing business customers and offer new services using both companies’ digital skills, networks and product portfolios, such as cloud, big data, Internet of Things and cybersecurity services.

The transaction is expected to close around the middle of 2021 and is subject to regulatory approvals, consummation of the recapitalizations, and other customary closing conditions

Telefonica Chief Executive Officer, Jose Maria Alvarez-Pallete, said,

“Combining O2’s number one mobile business with Virgin Media’s superfast broadband network and entertainment services will be a game-changer in the U.K., at a time when demand for connectivity has never been greater or more critical. We are creating a strong competitor with significant scale and financial strength to invest in UK digital infrastructure and give millions of consumer, business and public sector customers more choice and value. This is a proud and exciting moment for our organisations, as we create a leading integrated communications provider in the U.K.”

Mike Fries, Chief Executive Officer of Liberty Global, said,

“We couldn’t be more excited about this combination. Virgin Media has redefined broadband and entertainment in the U.K. with lightning fast speeds and the most innovative video platform. And O2 is widely recognized as the most reliable and admired mobile operator in the U.K., always putting the customer first. With Virgin Media and O2 together, the future of convergence is here today. We’ve seen the benefit of FMC first-hand in Belgium and the Netherlands. When the power of 5G meets 1 gig broadband, U.K. consumers and businesses will never look back. We’re committed to this market and are right behind the Government’s digital and connectivity goals.”

Financial Profile of the Joint Venture

Telefonica and Liberty Global say that they will ensure that the joint venture will benefit from the “scale and complementary expertise of each partner”. To accomplish that objective, the parties have agreed to provide a suite of services to the joint venture after closing. These services will principally consist of IT and technology-related services, procurement, brand management and other support services. The annual charges to the joint venture will ultimately depend on the actual level of services required.

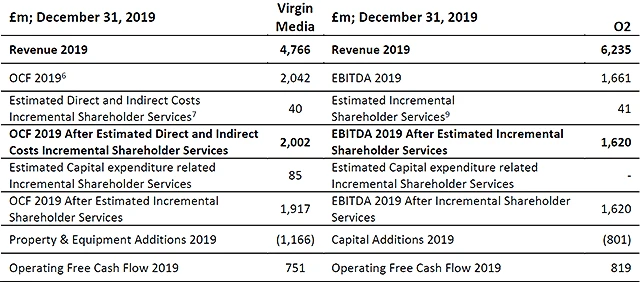

Separate financial information for Virgin Media and O2 is presented below for the 12 months ended December 31, 2019.

The joint venture intends to distribute available cash to the shareholders periodically and is expected to undertake periodic further recapitalizations, subject to market and operating conditions, to maintain its 4.0x-5.0x target net leverage ratio.

Between signing and closing, each party will retain the free cash flow of their respective operations. Liberty Global will transfer effectively all of its UK tax capital allowances and tax loss carry-forwards, which primarily resulted from prior infrastructure investments, at closing to be utilized by the joint venture. Each party will fund the deficit in their respective defined benefit pension schemes, arising from the next triennial actuarial valuation.

Neither Telefonica nor Liberty Global will consolidate the joint venture after the closing.

Transaction Details

The transaction will include a series of recapitalization financings prior to closing to reach its target closing net leverage ratio for the JV of 5.0x, or approximately £18 billion of long-term debt. Net new proceeds from the recapitalizations are targeted to be approximately £6 billion.

After taking into account the recapitalizations, Telefonica is expected to receive £5.7 billion in total proceeds from the transaction. Liberty Global is expected to receive £1.4 billion in total, including approximately £800 million from the recapitalization of its retained and 100% owned Virgin Media Ireland business.

The transaction will not trigger a change of control under Virgin Media’s existing third-party debt that will be contributed in full to the joint venture. As part of the transaction, a syndicate of banks has underwritten a £4 billion standalone undrawn financing on the O2 business.

Investor and Analyst Calls

Telefonica is hosting a conference call on Thursday, May 7, 2020 for analysts and investors, which will start promptly at 10.00 a.m. (London time). Please dial into this conference call using the following numbers:

UK Participant dial in Toll: +44 (0)330 336 9401

UK Participant dial in Toll-Free: 0800 279 4827

US Participant dial in Toll: +1 929-477-0338

US Participant dial in Toll-Free: 800-289-0459

Participant Passcode: 196368

Liberty Global is hosting a conference call on Thursday, May 7, 2020 for analysts and investors. The call will start promptly at 09.00 a.m. (New York Time). During the call Liberty Global will discuss its Q1 2020 results and business, and expects to address the joint venture, comment on the company’s outlook and provide other forward-looking information.

Please dial into this conference call using the following numbers:

United States: +1 720 543 0210

International: +1 888 378 4398

The conference passcode is 852843

The conference call will also be webcast live here.