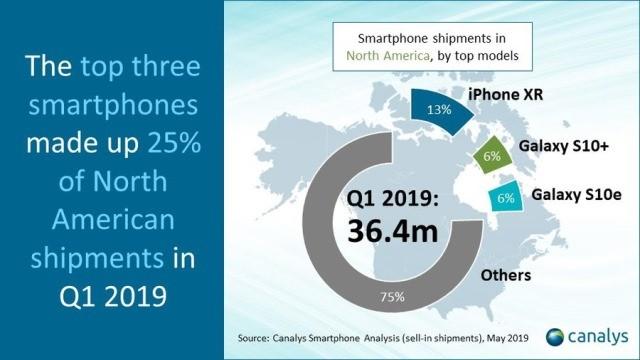

Smartphone shipments in North America dropped 18 percent in Q1 2019 to a five-year low of 36.4 million units.

Smartphone shipments in North America dropped 18 percent in Q1 2019 to a five-year low of 36.4 million units.

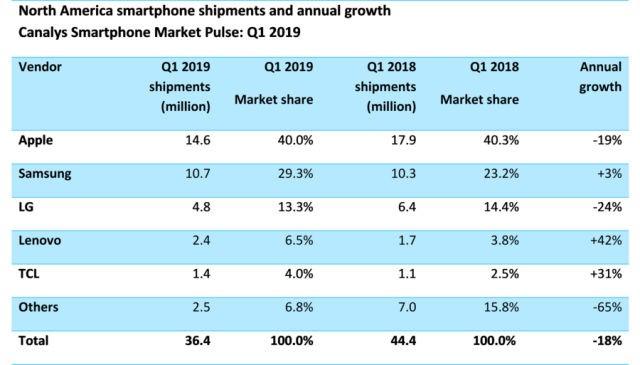

While the region’s biggest ever recorded fall in smartphone sales is being credited primarily to Apple’s lacklustre performance, the iPhone maker remained the clear leader despite suffering a regional decline of 19%.

Apple shipped over 4.5 million iPhone XR handsets in Q1 2019, whereas South Korean rival Samsung sold more than 2.0 million each of its Galaxy S10+ and S10e devices.

Apple with 40 percent market share, Samsung with 29.3 percent share, LG with 13.3 percent, Lenovo with 6.5 percent and TCL with 1.4 percent share are the smartphone leaders in North America.

“Samsung brought real differentiation to its Galaxy S10 devices,” Canalys Research Analyst Vincent Thielke said.

“Its triple camera, ultra-wide-angle lens, hole-punch display and reverse wireless charging all raised consumer interest. While these technologies are not new, Samsung is among the first to bring them to the U.S. in a mass-market smartphone, and the appeal of such new features will be important for other launches this year.

Samsung also benefited from carrier promotions in Q1, which used the Galaxy S10e as an incentive. But it will come under pressure later in 2019, as other vendors, such as OnePlus, follow suit with new features, while Google starts expanding into additional channels and price bands, and ZTE attempts to reestablish its footprint at the low end.”

Apple, the market leader, has shipped more than 4.5 million iPhone XR handsets during the first quarter. Samsung has shipped more than 2 million each of its Galaxy S10+ and S10e models.

Samsung enhanced its share to 29 percent against 23 percent in Q1 2018. Samsung scheduled an earlier launch date for the S10 series, and more than doubled shipments over the S9 series in their respective launch quarters.

Samsung benefited from carrier promotions, which used the Galaxy S10e as an incentive. However, it will face pressure as vendors such as OnePlus, Google and ZTE attempts to re-establish their presence. OnePlus will add more features, Google will reach more carriers and ZTE will have low-end phones.

Apple shipped 14.6 million iPhones in Q1 2019, down 19 percent, but maintained 40 percent share in North America.

Apple was helped by carrier and retail discounts on older models, such as the iPhone 6S and iPhone 7, as well as the growing use of trade-in promotions, according to Canalys Research Analyst Vincent Thielke.

The unlocked smartphones market in the United States declined 12 percent in Q1 2019, said a report from Strategy Analytics. BLU has regained the top position, followed by Lenovo, Samsung, LG, Apple, Google and TCL in the US unlocked smartphone market during Q1 2019.